Political Risk in International Business: What is it?

By

bound-team

In recent times, the increased levels of interconnectedness that exist throughout the world have allowed more small and medium-sized enterprises to take advantage of opportunities to do business internationally. Operating internationally allows SMEs to grow and increase their sources of revenue.

Operating internationally is no longer just something for large corporations. Many businesses, nowadays, at least have the potential to move towards international operation and more and more SMEs are doing so. Meanwhile, they are also learning how to overcome the new problems that they encounter as a result.

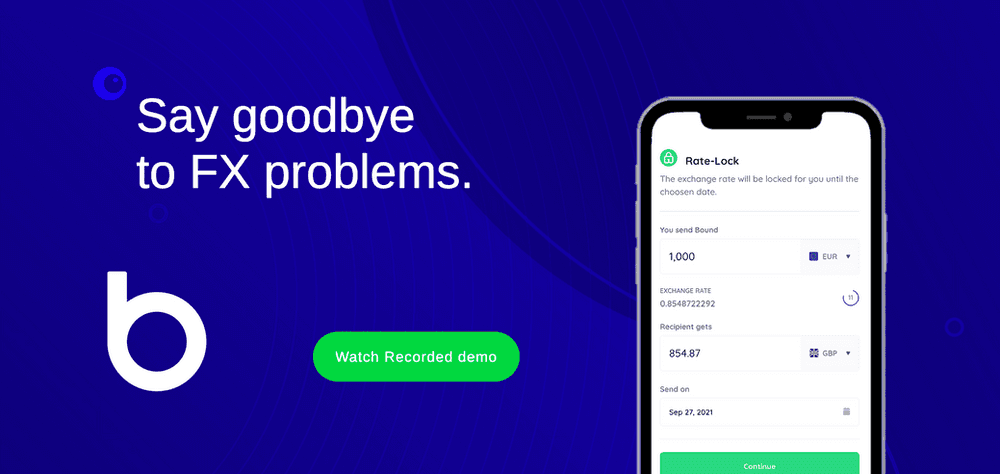

Bound specialises in dealing with one significant risk that is posed to businesses that operate internationally. That risk is currency risk, which is the risk that changes to the exchange rate can cause money to be lost.

Another significant risk that businesses also face is political risk.

What is Political Risk In International Business?

Political risk is the risk that a firm could lose money to political events that take place in a foreign country in which it operates. Government actions and political unrest in that country can all impact a firm’s operations and profitability by making it more expensive, more difficult, or even impossible to reach its original objectives.

Some forms of political risk, such as the potential for a government to nationalise industry and to take ownership of a firm’s assets without compensation, are (to some companies) potentially severe.

While political risks are often directly related to government activity, that is not always the case. Civil unrest is an example of a political risk that occurs in spite of a government’s attempts to maintain stability. Widespread riots, for example, could impact a business by disrupting supply chains and other business networks.

While a high level of political risk is more often associated with doing business in developing countries, it also exists in developed countries as well. While it may take a different form in developed countries it is still sometimes a significant risk. The impact that Brexit has had on overseas firms which operate in the UK is an example of a political event in a developed country causing financial disruption to foreign-based firms.

The term political risk is closely related to country risk. However, country risk refers to the risks associated with doing business in a particular country.

Political risk is often divided into macro-level risk and micro-level risk.

Macro-Level Political Risk

Macro-level risks are risks that are not associated directly with operations conducted by a firm. Macro-level risks affect businesses and citizens across a country and can also be events that have a regional or global impact. Macro-level political events will often alter the overall suitability of a country for investment. A country going to war or deciding to separate into smaller territories are all obvious examples of macro-level political risk.

Micro-Level Political Risk

Micro-level risks are risks that are more directly associated with operations conducted by a firm. These risks usually affect specific companies or areas of the economy. Tariff introductions, government regulations to specific industries, or initiatives that are designed to favour local businesses are all examples of micro-level political risk.

What is Currency Risk?

As we mentioned earlier, currency risk is another significant risk that internationally operating businesses face. This is the risk that a change in the exchange rate will cause a business to lose money.

The most common form of currency risk is known as transaction risk and is a simple form of risk. This is the risk that a company will commit itself to a future exchange of currencies that, when the time comes to complete it, will have to be done at an unfavourable exchange rate.

The simple risk is that in the time between a company agreeing to complete a transaction in a foreign currency and the money actually changing hands, the exchange rate could change for the worse. When currencies are then exchanged for the transaction, profits can be reduced or, if the transaction is a purchase, expenses can be higher than anticipated.

Bound specialises in providing fast, effective and simple ways to eliminate currency risk. By using financial products provided by companies like Bound it is possible for companies that operate internationally to have complete certainty about the exchange rate that they will be able to receive for long periods of time.

In many cases, it is possible to both eliminate the risk of an unfavourable change to the rate having an effect while still leaving the possibility of benefiting from a favourable change to the exchange rate.

What are the Main Types of Political Risk?

While there are a huge number of potential political risks for businesses that operate internationally, these are some of the main ones…

Government Expropriation

Perhaps one of the more intriguing forms of political risk is expropriation by the local government. Expropriation is when a government takes control of private assets and can affect businesses as well as individuals.

Nationalisation

As we mentioned earlier, one potentially serious risk is the risk that a government could seize an entire business operation. Known as nationalisation, there are various reasons why a government may choose to take ownership of a business. In some cases, this is done without any compensation being given to the foreign company which has made an investment.

In many cases, international businesses will choose not to invest in a country where nationalism is likely to take place. However, it can take place unexpectedly or happen to businesses that have operated in a country for a long period of time.

One incidence of government nationalisation happened in 1972 when the socialist government of Chile, led by Salvador Allende, nationalised the operations of various US companies (Anaconda, Kennecott, and Cerro) that existed in the copper mining industry. In order to do so, the government had to modify the Chilean constitution.

Forced Divestiture

In some cases, a national government in a foreign country in which a business operates may force the business to sell off part of its ownership of a local business operation.

Asset Confiscation

Again, in some cases, local governments may choose to confiscate particular assets owned by foreign companies. If no compensation is provided, the company may face a significant financial loss and could also face difficulty in conducting its business operations without important assets.

Gradual Expropriation

As well as taking place suddenly and obviously through nationalisation, forced divestiture or asset confiscation, expropriation can also take place more gradually.

In gradual expropriation, a local government will gradually seek to effectively seize a business. Gradual expropriation can take many forms but often involves increasing taxes on profits, increasing property taxes, or the introduction of barriers that prevent normal operation.

Contract Termination

It may be that political events that take place in a country make it impossible to keep a contract held by a foreign company. Rather than there being any targeted action against a company, as with government expropriation, sometimes events just make it impossible to continue doing business. A change to local laws, for example, that is not enacted to target a company may make it impossible for a company to meet its original contractual obligations.

Transfer Restrictions

In many cases, changes to local laws may hamper a business by making it difficult to transfer essential things in and out of the country. Limitations can be imposed on the transfer of things such as specialist staff, capital, and equipment and this can hamper business operations.

Sanctions

Similarly, sanctions may be imposed on a country that could hamper the ability of a foreign company to import commodities or other things that it requires as part of its business operations.

Currency Restrictions

In some cases, a government may decide to impose regulations on its currency. For example, a government may choose to ban the conversion of its local currency into foreign currencies. This particular rule is often introduced in developing countries in order to provide a level of exchange rate stability. With locals unable to participate in the foreign exchange market, the government is able to have a high level of control over its currency’s exchange rate at times of economic instability.

Where restrictions such as this are introduced, it can make it difficult for a business to operate. For example, if a company has earnings in a foreign currency that it is unable to convert it into its own domestic currency it will be unable to repatriate its profits. In the long term, there are ways around this problem (such as using an alternative currency for business operations), however, restrictions like this can still seriously hamper a foreign-based company.

Terrorism, War and Unrest

Some other examples of political risks that can cause serious disruption are war, terrorism, and civil unrest. If a company invests in a country that subsequently goes to war or faces a serious level of civil disorder through terrorism or civil unrest, they may find that they struggle to or are unable to conduct business operations. In some cases, the networks on which a business relies will be seriously damaged for a long period of time.

The Arab spring that started in the early 2010s is a good example of civil unrest that led to widespread economic disruption. Businesses that operated throughout the Middle East were seriously affected by the events which unfolded after the initial protests and are still affected by them as they continue to take place today.