Dear Bound Customers

By

bound-team

From my seat in our offices in Soho, London and looking forward into 2022, it looks like another volatile year for currencies. As businesses that have to deal with the financial risk from fluctuating exchange rates, it looks like 2022 could cause some headaches.

The lingering impact of Covid, potential geopolitical struggles between superpowers, inflation and changing interest rates all indicate volatility for currencies.

We’re looking forward to helping this year as you protect your businesses from FX losses.

With that in mind, I want you to know what you can expect from Bound.

Bound’s Dream for You

Before I get into anything specific about this year, I want to share the guiding principles behind all of Bound’s interactions with you, our customers.

Our long-term goal is to make FX effortless for business. We want to make FX risk management so easy that in the future you can transact internationally without even thinking about other currencies.

This effort will take us years to deliver, but along this journey we will always be thinking about these statements.

We customer trust. We promise you transparency and fairness in order to win your trust. This is true in our pricing and in all our interactions with you.

We customer savings. We promise you low, consistent fees and we promise no one at Bound will ever have a commission incentive to play games with your exchange rates.

We customer ease. We promise to invest millions developing technology that will make FX simpler and more secure for your business.

For 2022

As the person who looks after the finances of a business that transacts internationally, you probably find yourself falling into one of the following three categories when it comes to FX risk management:

SPOT CONVERTER: I exchange currencies when foreign currencies come in or when I need to send them out.

BANK USER: I’ve started using forward contracts or other financial instruments from my bank to manage my company’s exposure.

VICTIM OF THE RATE WARS: I’ve entered the chaotic world of dealing with FX brokers.

\n

Spot Converter

Whether you let currencies convert automatically with your bank or you have a multi-currency account and keep an eye out for an advantageous day to switch between currencies, FX hasn’t risen to a business-critical level.

You probably don’t like reporting FX losses when they creep into your finances, but they haven’t been large enough or painful enough to take more strategic action. Or maybe you don’t account for FX losses at all. Either way, actively managing FX takes effort. This approach makes sense for firms with small gains and losses on FX where the effort would outsize the potential losses.

You likely know this isn’t an optimized approach to FX. You know you may find yourself needing to convert between currencies at a suboptimal time because you can’t wait for a more advantageous rate.

You also might have a nagging feeling that you should be doing something more proactive to manage FX risk, but it keeps sliding down the priority list and losing out to other projects.

Bank User

FX has become a big enough or complex enough problem for your business that you’ve decided to take strategic action. Or perhaps a painful FX loss has inspired you to think more about the risks lurking in your finances. Either way, this is probably a sign of business growth, so that’s great.

Often when a business first decides to actively manage it’s FX risk, it turns to its bank. Dealing with the bank is the familiar option and you likely trust your bank as a safe place to store your funds.

Bank systems generally are not user-friendly and you probably need to go through a manual process on the phone every time you need to transact. In addition to those small inconveniences, the toughest challenge with using your bank is bad pricing. Generally banks provide the worst pricing in the market. Cases can vary, but oftentimes a bank’s fees (hidden or explicit) can be as much as five to ten times the amount of a specialist FX broker.

At some point, the extremely high fees or uncompetitive rates from your bank is worth the extra step of working with an FX broker.

Victim of the Rates Wars

At some point you agreed to take a call from one of the incessant FX brokers calling your office. That led to a conversation about rate comparisons. You provided some details from recent transactions or you compared rates live. You were blown away by how much you can save–how much cost you were unknowingly paying to your bank.

You’ve entered the rate wars.

Now there seems to be an endless army of FX brokers calling your office and wooing you with the promise of ever-more competitive exchange rates for your transactions. Sometimes you entertain a rate comparison and sometimes you’ve got more important work to do.

When a fresh rate comparison reveals that your FX broker has given you extremely competitive rates, you’re validated. When the rate comparison reveals that your rate was not competitive, you feel duped and feel like you’re right back in the place you were with your bank before. Because you are.

If you’ve been trading FX for long, you’ve seen this cycle go round multiple times.

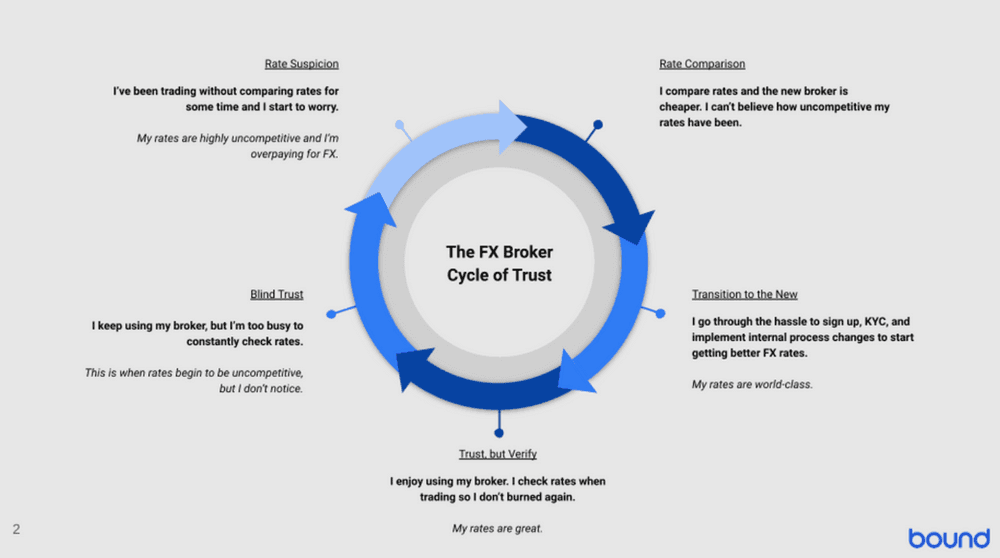

The FX broker cycle of trust usually looks something like this:

Regardless of where you are currently in this cycle, you recognize that this is a fatiguing process. Bound is here to help you exit this cycle for good so you can focus on your core business.

From Bound in 2022

In 2022, we hope to get you out of the rate wars and help you remove yourself from the FX broker cycle of trust.

In fact, at Bound, we’re obsessed with restoring trust in FX.

Whether you are a spot converter, a bank user or if you’re already a victim of the rate wars, here are our promises to you for 2022 in our effort to become the digital FX broker that you can trust:

We promise to give you completely transparent pricing for every transaction.

We promise to give you fair, consistent fees. Our fees will never surprise you.

We promise to deliver you a digital experience that is pleasant to use backed up with honest, quick support that is one-click away.

These features are simple but the impact is significant. Transparency means you’ll see the best price we can find for you in the market, our fees and the ultimate amount of money your beneficiary will receive. This forces us to keep our fees fair.

We know that you often need to check with multiple brokers when you transact to ensure you’re getting a fair rate. We know that process is a time consuming hassle. Of course, you’re always free to check our rates and compare, but we won’t ever hide anything in the exchange rates. You see what we see.

And if you ever have questions when you’re online, we have online support and phone support to help you through your transactions.

Seth